Climate change has a significant impact on our supply chain,

customers, and operations, and its effects are being felt

worldwide. This means that we not only have a responsibility

to transition to low-carbon practices but also to protect our

assets from climate events and meet regulatory and customer

expectations. We focus on addressing climate change by

embracing low-carbon transition and building resilience.

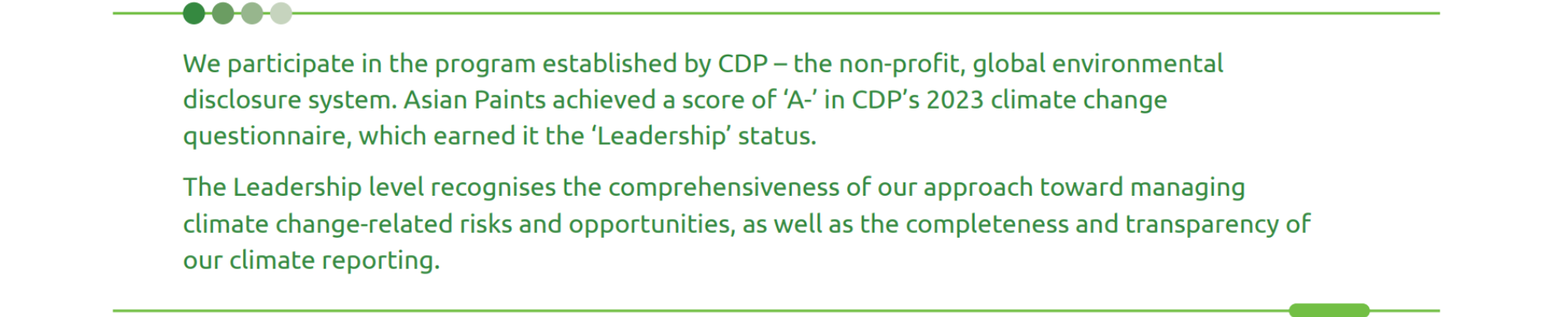

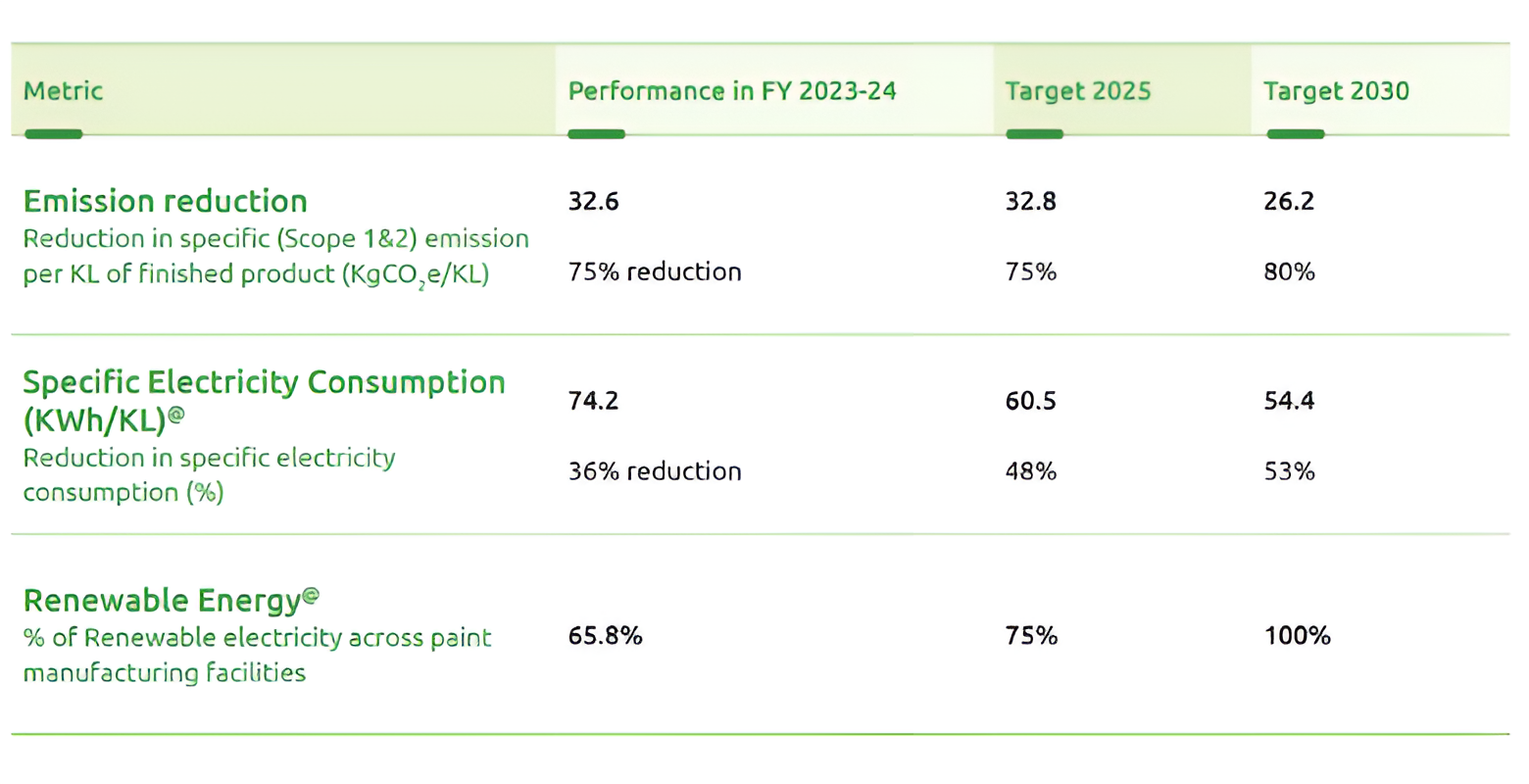

Over the past decade, we have diligently tracked our Scope 1

and Scope 2 emissions, achieving significant reductions in both

absolute and intensity terms. Our commitment to sustainability is

reflected in our 2025 and 2030 targets set to further reduce the

intensity of these emissions. In the previous year, we conducted

a thorough inventory of our Scope 3 emissions and developed

strategies to mitigate value chain emissions, with a focus on

our sustainable supply chain program as the primary driver.

Additionally, we took proactive measures by conducting a climate

scenario analysis, risk assessment, and planning activities to

enhance our responsiveness to climate change, aligning with the

Task Force on Climate-related Disclosures (TCFD).

Decarbonisation at Asian Paints

Our commitment to reducing our carbon footprint entails a comprehensive assessment of emissions generated from both our operations and the entire value chain. Emissions stemming from our operations are largely attributed to the use of fuels and grid electricity, whereas the majority of emissions within the value chain originate from suppliers and transportation. Energy and resource utilisation directly contribute to the majority of these emissions. Our decarbonisation strategy focusses on the following key enablers addressing both direct and indirect emissions.

Key enablers to address emissions at different value chain stages have been illustrated below:

Own operations – Scope 1 and Scope 2 emissions

Over the decade, we have achieved significant reductions in absolute Scope 1 and Scope 2 emissions in our decorative paint business. We have reduced our Scope 1 emissions by 41% and our Scope 2 emissions by 47% from FY 2013-14. In addition, our emission intensity decreased by 75% from the baseline year, achieving the 2025 commitment ahead of schedule. The Scope 1 and Scope 2 emissions on a standalone basis during the year were 72,794 tCO2 e & 44,357 tCO2 e respectively. The emission intensity was 88.6 KgCO2 e/KL. Biogenic emission due to the combustion of biofuels was 338 tCO2 e.

E1: Energy Efficiency

Efficient energy consumption is a key enabler of the

reduction of our Scope 1 and Scope 2 emissions. Our

commitment to lower energy usage depends on process

enhancements, investments in advanced technologies, and

upgrading existing infrastructure to incorporate energyefficient assets. This is further supported by constant

trainings and awareness campaigns on energy efficiency.

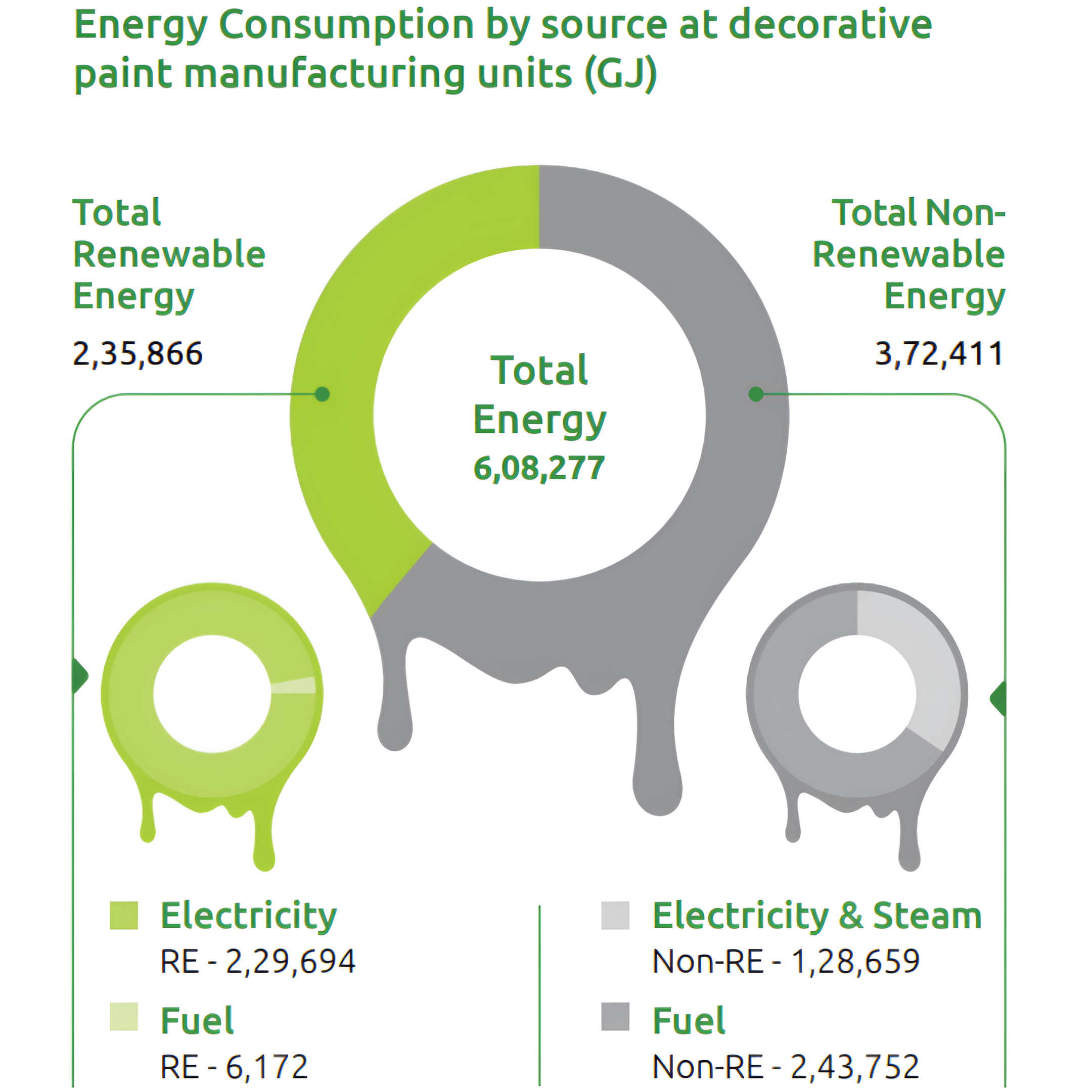

During the year, the total energy consumption at our

decorative paint manufacturing units stood at 6,08,277 GJ,

and renewable energy consumption contributed 2,35,866 GJ.

We have been monitoring and concentrating on Specific

Electricity Consumption reduction at our decorative paint

manufacturing units.

In FY 2023-24, total energy consumption on a standalone

basis stood at 12,92,545 GJ, of which 9,33,022 GJ contributed

to direct energy consumption and 3,59,523 GJ contributed

to indirect energy consumption. During the year, 12,329 GJ

of steam was procured and included in indirect energy. The

energy intensity was 0.98 GJ/KL.

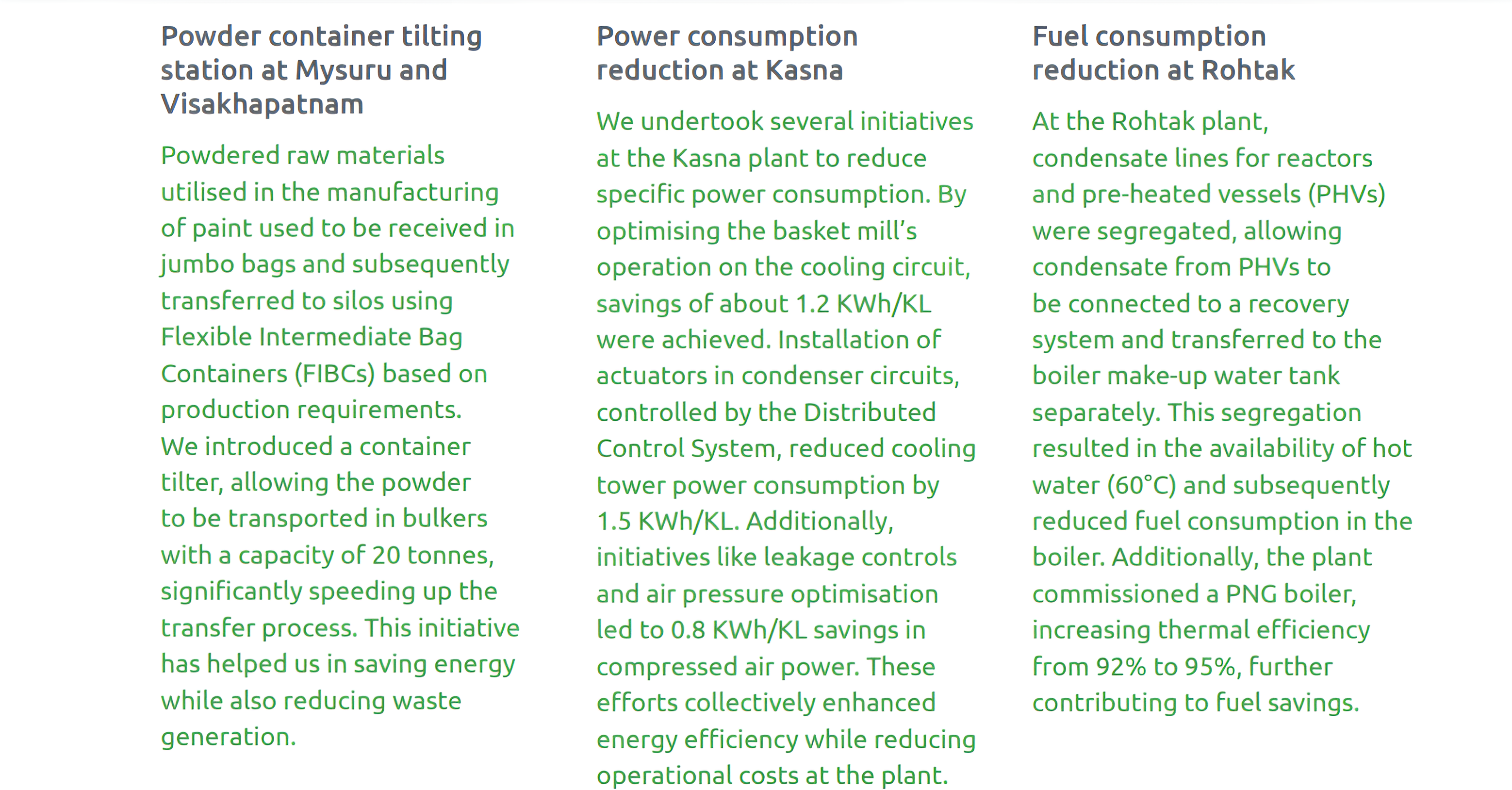

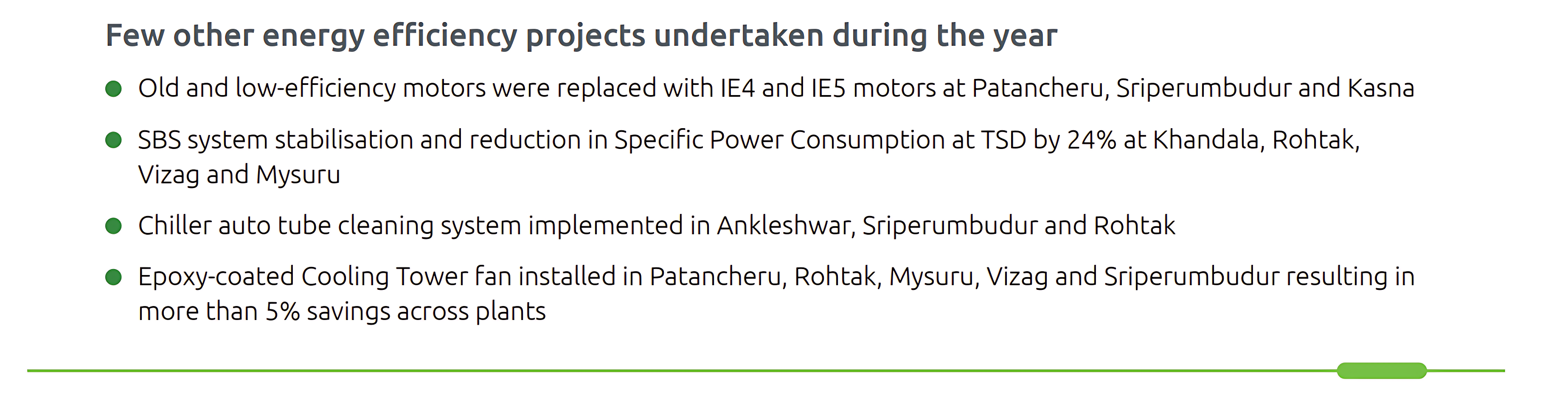

Through the monitoring of extensive data across plants using the Energy Management System (EMS) software, we track inefficiencies and generate insights for improvements. In addition, to strengthen our procedures, we have an effective energy audit system. With multiple interventions during the year, we were able to reduce our energy consumption by 1,972 GJ at our decorative paint manufacturing units.

E2.Renewable Energy

Over the past decade, we have made consistent progress in our transition to renewable energy through ongoing investments

in solar and wind electricity projects. Currently, our decorative paint manufacturing plants feature an installed capacity

of 48.9 MW, with 24.6 MW from solar installations and 24.3 MW from wind installations. The overall contribution of renewables

to our electricity consumption has risen to 65.8%, up from 62.2% in the previous year. Notably, we avoided emitting

6,164 tCO2

e through the increased use of renewable electricity at our decorative paint manufacturing units against last year’s

base. Furthermore, we are now working on increasing our reliance on biofuels for heating requirements.

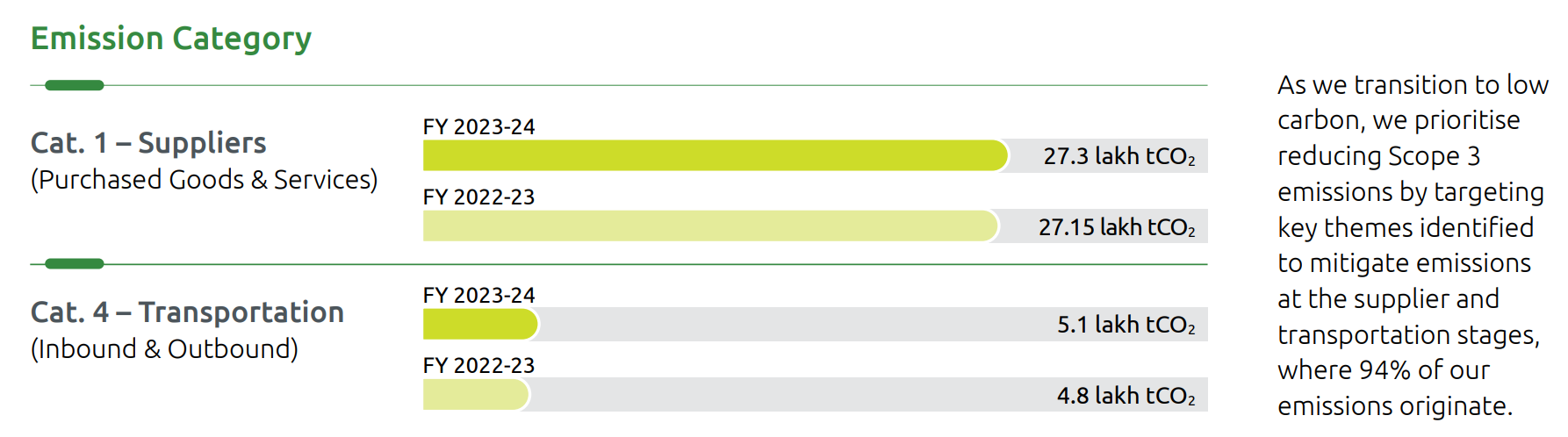

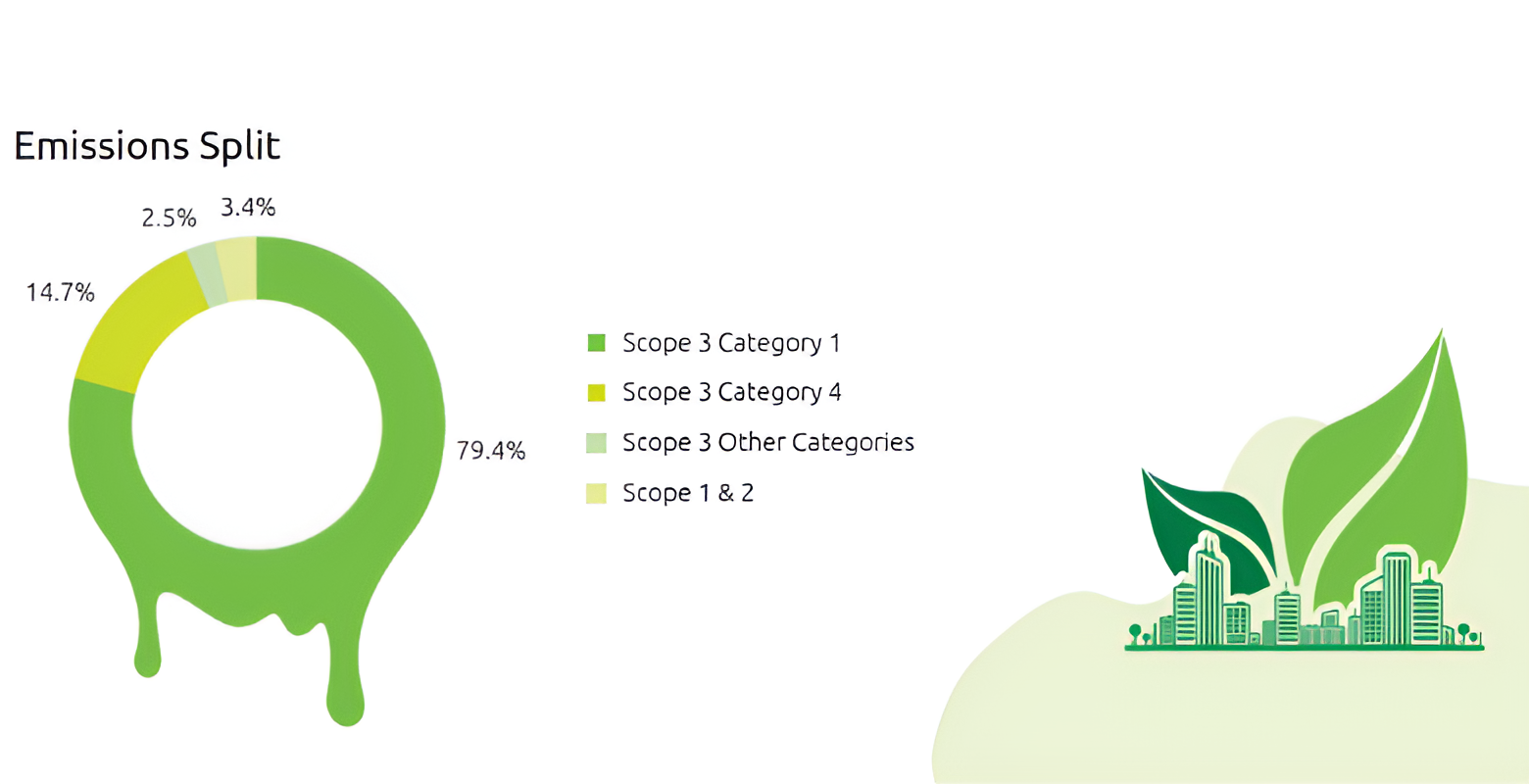

Value Chain -Scope 3 Emissions

During the year, our total Scope 3 emissions were estimated at 33.2 lakh tCO 2

e.

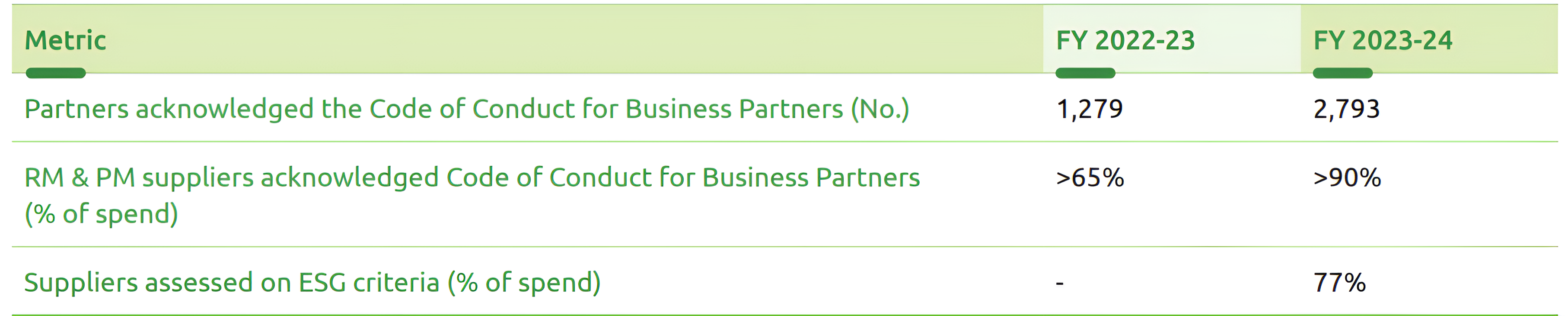

Supplier Engagement

During FY 2022-23, we carried out a climate risk assessment in line with the TCFD recommendations. The assessment covered

Physical and Transition Risks and involved identifying and engaging all relevant internal stakeholders, gathering inputs on key

issues, prioritising climate risks, utilising scenarios to spot risks and opportunities, evaluating business impact, devising potential

responses, and disclosing the findings.

The assessment helped us understand the Physical and Transition Risks we are exposed to, and while the exposure was minimal,

it encouraged us to strengthen our adaptation strategy with stronger resilience measures. The potential climate change

adaptation risks are part of our Risk Management framework. The detailed outcome of the assessment has been discussed in

our Sustainability Report for FY 2022-23.

Learn more about our approach to risk management in our TCFD Index.

The Physical Risk Analysis analysed

acute and chronic risks caused by

extreme weather events and longterm changes in climate patterns at

our 8 decorative paint manufacturing

locations in India.

The risks were analysed over the

short-term (2030) and long-term

(2050), using IPCC RCP 4.5 (moderate

climate change scenario) and RCP 8.5.

(high climate change scenario). To

facilitate effective decision-making, a

composite risk rating was calculated

based on the likelihood and impact

of the risks considering RCP 4.5 as

a probable scenario and short-term

(2030) time horizon for risks such as

heatwaves, drought, cyclones and

floods. Resilience measures are already

part of the design for climate events

like cyclones, and floods depending on

the geography. Similarly, our approach

towards addressing water risks

already encompasses the reduction

of non-process water consumption

as well as increasing rainwater and

greywater utilisation across our plants.

As per Central Ground Water Board’s

classification, none of our sites are

located in water-stressed areas. For

other physical risks, resilience measures

have been identified and are being

implemented to mitigate them.

During the year, we have undertaken

projects to improve ventilation on the

floor, augment rainwater harvesting

capacity within the plant, and intensify

our training and awareness efforts for

heatwave and monsoon preparedness

Transition Risk Analysis

Transitioning to a lower-carbon

economy may entail policy and

legal, technology, and market

changes that create both risks and

opportunities. Transition Risks include

policy and legal risks, market risks,

reputational risks and technology

risks as well as opportunities

under categories of products and

services, resource efficiency and

energy source. To analyse the risks

we could face, we conducted a

comprehensive assessment aligned

with the International Energy

Agency’s scenarios (IEA SDS) and

India’s Net Zero commitments and

current and anticipated policies.

Our comprehensive ESG agenda

strengthens our preparedness and

response to various identified risks

while also leveraging the opportunities

they present.